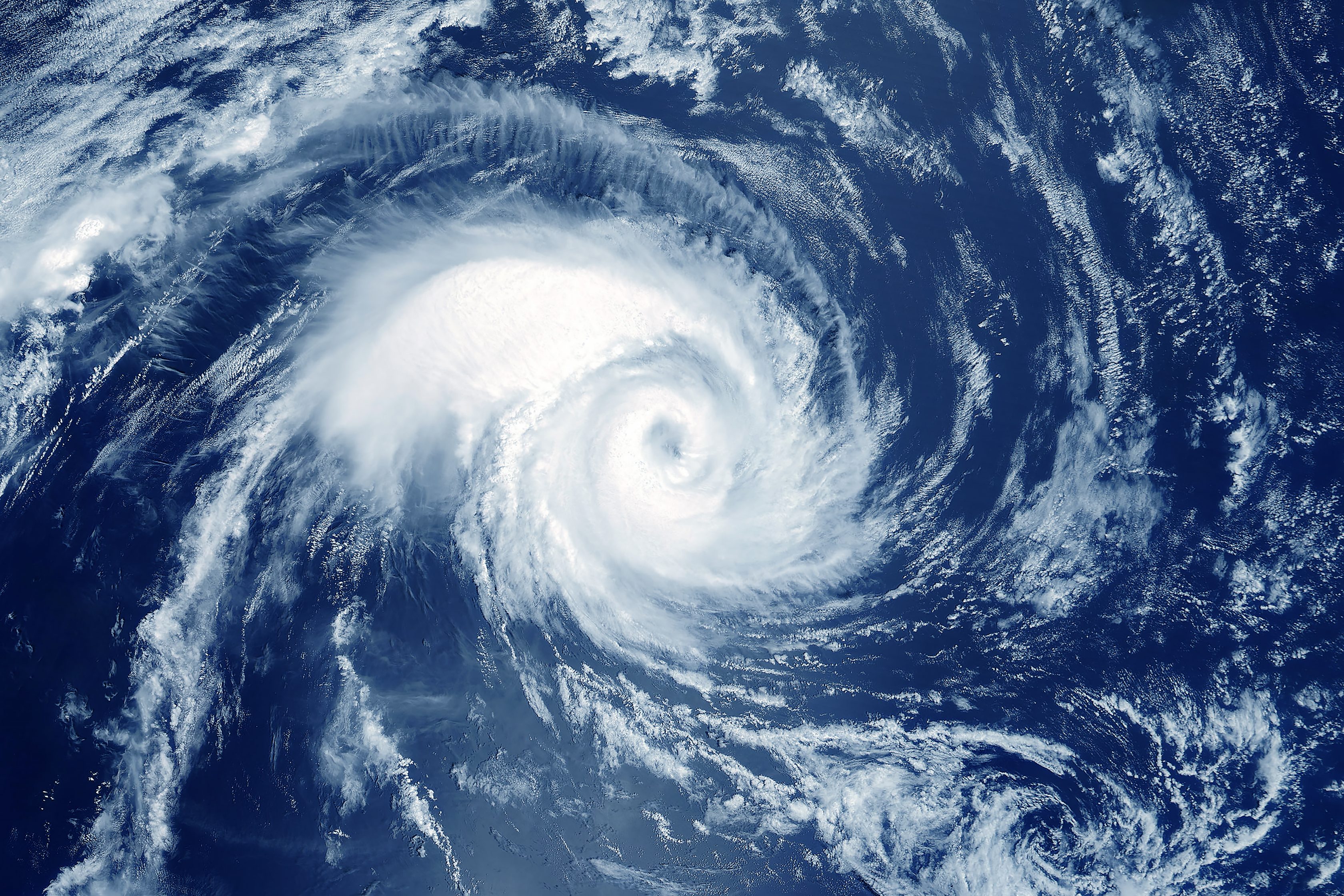

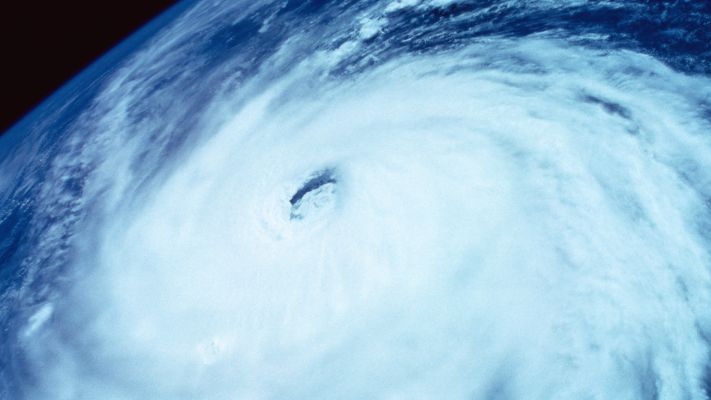

Demographic shifts, increasing global interdependencies and climate change all play a role in weather-related insurance losses. Such losses have increased 15-fold over the last few decades, implying high risk and volatility for the insurance industry. Mitigating against this requires a distinct catastrophe risk management approach.

At Allianz Re, our meteorologists, hydrologists, seismologists, geographers and mathematicians currently model around 50 nat cat scenarios for the Allianz Group, with data captured using best-in-class standards. Applying their understanding of these perils to the Allianz portfolio with its insured values, they assess its overall nat cat risk. Vendor and in-house applications build a quick picture of risk accumulation in any defined location, forming the basis for effective risk management measures.

Nat Cat Management

The Nat Cat team at Allianz Re categorizes the management cycle into three components:

- Knowing your risk - an in-depth understand of portfolio itself

- Understanding your risk - using the correct tools and models to carry out an appropriate hazard and risk analysis.

- Managing your risk - portfolio optimization by means of risk pooling, traditional retrocession, capital market solutions or a blend of all.

Major Natural Catastrophes include windstorms, floods, earthquakes.